Alison Pryde

- Director

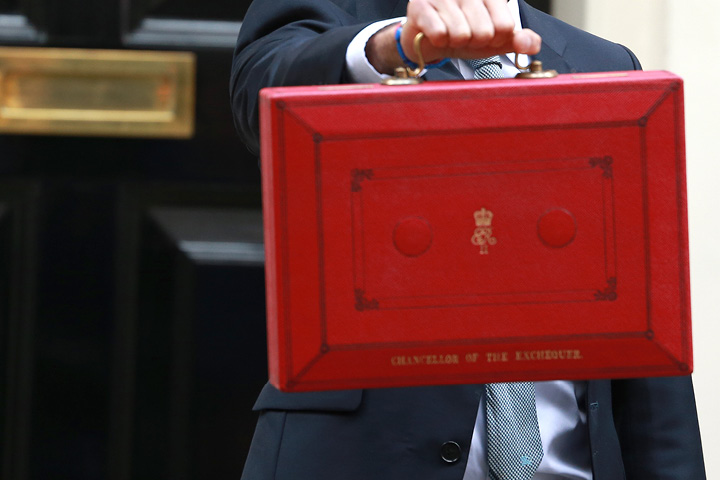

Chancellor Rishi Sunak revealed his Autumn Budget on 27th October, but what will the impact be for individuals?

After having announced the Health and Social Care Levy in September, which imposes a 1.25% increase in National Insurance and dividends tax, it remained to be seen whether further tax rises would be announced.

The Chancellor promised that his budget would set the stage for a new age of optimism and the foundation of a stronger economy. The challenge is how this is to be achieved taking into the account the need for the government to cut the gap between what it spends, and what it raises within the context of the rising cost of living.

The full picture for Scottish taxpayers will not be known until the Scottish Government’s own budget is held on 9 December 2021.

The rates and bands for personal income tax, and land and buildings transaction tax, are devolved to the Scottish parliament. Scottish income tax applies to earnings of Scottish taxpayers arising from employment, self-employment, pension income and property income. Scottish taxpayers continue to be subject to UK income tax rates for savings and dividend income.

The UK budget deals with UK-wide aspects of private wealth, particularly in relation to savings and investment, capital gains tax (CGT) and inheritance tax (IHT), plus Stamp Duty Land Tax (SDLT) on properties in England and Northern Ireland. CGT and IHT are not devolved to the Scottish Government.

The Autumn Budget ultimately delivered very little in the way of tax changes for private individuals with no announcements on IHT or SDLT. CGT changes were limited to the administration of the tax.

The income tax personal allowance was increased in the Spring Budget to £12,570 for the 2021/22 tax year. The higher rate (40%) threshold was also increased in line with inflation to £50,270. At that time the Chancellor announced that both the personal allowance and higher rate threshold would remain at these levels until 5 April 2026. There is no change to the UK basic rate (20%) or additional higher rate (45%) thresholds.

As announced on 7 September 2021 the rates of income tax on dividend income will increase by 1.25% from 6 April 2022. Taxpayers who receive total dividend income in the tax year of less than the dividend allowance will not pay any tax on that income. The dividend allowance remains at £2,000. Basic rate taxpayers will pay tax on dividends at the rate of 8.75%. The dividend rate increases to 33.75% where dividends fall within the higher rate tax band and to 39.35% where dividends fall within the additional rate band.

The dividend trust rate also rises to 39.35%.

The NICs primary threshold and lower profits limits for employees and self-employed will increase from £9,568 to £9,880 with effect from 6 April 2022. As previously announced the upper earning limit will be maintained at £50,270 until April 2026 at the earliest. The NICs thresholds apply across the UK.

The new 1.25% Health and Social Care Levy will apply from April 2023. Prior to its introduction and with effect from April 2022 NICs paid by employers, employees and the self-employed will all increase by 1.25%. NI rates will return to their existing levels from April 2023 when the temporary increase is replaced by the standalone 1.25% levy.

Employees and the self-employed who are over the state pension age are not liable to pay NIC and will not be subject to the additional 1.25% NIC charge in 2022/23. The levy will apply to the earnings of those over state pension age.

Despite continuing speculation there has again been no change in the rates of CGT for individuals where the rates are 10% for gains within the available basic rate band and 20% for gains within the higher rate and additional higher rate bands. The rate for trustees remains 20%. In both cases, the additional 8% surcharge on gains on residential property remains unchanged. The CGT annual exemption for individuals and executors will remain at its current level of £12,300 (£6,150 for trustees) until 2026 at the earliest.

A welcome change is an increase in the time limit from 30 days to 60 days for making CGT returns and associated payments on accounts when disposing of UK land and property. The requirement to file a CGT return applies to UK residents who have CGT to pay on the disposal of residential property in the UK. Non-UK residents must file a return in respect of a disposal of an interest in UK land regardless of the type of property or whether there is tax to pay. The extension applies to disposals that complete on or after 27 October 2021.

The savings income that is subject to the 0% starting rate will continue to remain at its current level of £5,000 in the 2022/23 tax year.

The current 2021/22 Individual Savings Account (ISA) (£20,000), Junior ISA (£9,000) and Child Trust Fund (£9,000) annual contribution limits will remain unchanged in the 2022/23 tax year.

The earliest age most individuals can access their pensions without incurring an unauthorised payments tax charge will be increased from 55 to 57. This increase will have effect from 6 April 2028.

No changes were made to the current lifetime allowance for pension savings of £1,073,100 as the Spring Budget froze the allowance at this level until the end of the 2025/26 tax year. No changes were announced to the annual allowance or tapered annual allowance thresholds.

As announced in the Spring Budget the IHT nil rate band (currently £325,000), the IHT residence nil rate band (£175,000) and the IHT residence nil rate band taper threshold (£2 million) will remain frozen at their current levels until the end of the 2025/26 tax year. This means that the IHT nil rate band will have remained at the same level of £325,000 for 17 years since it was raised to that level from the start of the 2009/10 tax year.

For more on the IHT residence nil rate band read Martin Campbell’s article explaining how it works in practice.

The widely anticipated reform of IHT following a review by the Office of Tax Simplification and the All-Party Parliamentary Group on Inheritance and Intergenerational Fairness has again failed to materialise.

The business tax related measures announced at the UK Budget included:

No changes to SDLT were announced with the SDLT nil rate band for residential property in England and Northern Ireland having returned to its standard amount of £125,000 from 1 October 2021 after the temporary increase under the UK Government’s Coronavirus support package.

Our Private Client Services team offers a full portfolio of advisory services in tax planning, asset protection and family advice. It’s a solution that is always tailored to meet each client’s individual and family needs.

For further tax compliance or tax planning advice, please contact Martin Campbell, Director of Tax Services or Alison Pryde, Tax Director in our tax department. We would strongly recommend that you seek specialist advice tailored to your own circumstances before taking any action.

For financial planning and investment advice, please contact James Glass and Neil Cameron at Anderson Strathern Asset Management Limited.

Anderson Strathern Asset Management Limited is authorised and regulated by the Financial Conduct Authority.