Martin Campbell

- Partner

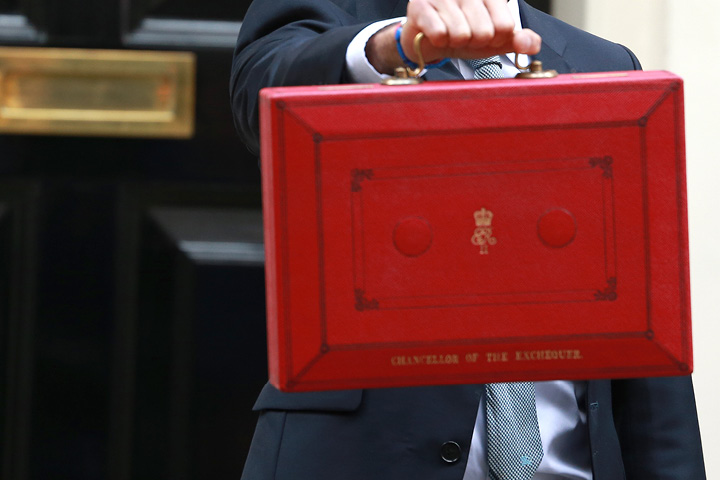

Chancellor Rishi Sunak revealed his Budget on 3rd March, but what will be the impact for private individuals?

The Chancellor vowed to “protect the jobs and livelihoods of the British people” against the backdrop of the UK emerging from the Coronavirus pandemic.

As ever with tax, the devil is in the detail and this article takes a look behind some of the headlines to see if the Chancellor’s Budget delivers on its promises.

The impact of the UK Budget on Scottish taxpayers following the Scottish Government’s own budget on 28 January 2021 is covered in more detail in our Scottish Budget report.

The rates and bands for personal income tax, and land and buildings transaction tax, are devolved to the Scottish parliament. Scottish income tax applies to earnings of Scottish taxpayers arising from employment, self-employment, pension income and property income. Scottish taxpayers continue to be subject to UK income tax rates for savings and dividend income.

The UK budget therefore deals with UK-wide aspects of private wealth, particularly in relation to savings and investment, capital gains tax (CGT) and inheritance tax (IHT), plus SDLT on properties in England and Northern Ireland. CGT and IHT are not devolved to the Scottish Government.

The UK income tax personal allowance increases in line with inflation to £12,570 in the 2021/22 tax year. The higher rate (40%) threshold will also increase with inflation to £50,270. The personal allowance and higher rate threshold will remain at these levels until 5 April 2026. There will be no change to the UK basic rate (20%) or additional higher rate (45%) thresholds. Our Scottish Budget report sets out Scottish income tax rates for Scottish taxpayers for the 2020/21 tax year.

The Office for Budget Responsibility has estimated that this freezing of the personal allowance and higher rate threshold will result in around 1.3 million more people paying income tax and over 1 million more people paying income tax at the higher rate.

From 6 April 2021 large and medium businesses in the private sector will become responsible for the assessment of an individual’s employment status when they are engaged to carry out work. This measure introduces an additional layer of compliance to the existing off-payroll working rules (IR35) and will bring parts of the private sector into line with the rules applied in the public sector. This extension of the rules to the private sector had been delayed 12 months as a result of the Covid pandemic.

The NICs primary threshold and lower profits limits for employees and self-employed will increase from £9,500 to £9,568 with effect from 6 April 2021. The upper earning limit will also be increased in line with inflation from £50,000 to £50,270 and will be maintained at this level until April 2026 at the earliest. The NICs thresholds apply across the UK.

Despite the speculation there was ultimately no change in the rates of CGT for individuals where the rates are 10% for gains within the available basic rate band and 20% for gains within the higher rate and additional higher rate bands. The rate for trustees remains 20%. In both cases, the additional 8% surcharge on gains on residential property remains unchanged. The CGT annual exemption for individuals and executors will remain at its current level of £12,300 (£6,150 for trustees) until 2026 at the earliest

The savings income that is subject to the 0% starting rate will continue to remain at its current level of £5,000 in the 2021/22 tax year.

The current 2020/21 Individual Savings Account (ISA)(£20,000), Junior ISA (£9,000)and Child Trust Fund (£9,000) annual contribution limits will remain unchanged in the 2021/22 tax year.

The current lifetime allowance for pension savings of £1,073,100 will be frozen at this level until the end of the 2025/26 tax year. No changes were announced to the annual allowance or tapered annual allowance thresholds.

The Inheritance Tax (IHT) nil rate band (currently £325,000), the IHT residence nil rate band (£175,000) and the IHT residence nil rate band taper threshold (£2 million) will remain frozen at their current levels until the end of the 2025/26 tax year. This means that the IHT nil rate band will have remained at the same level of £325,000 for 17 years since it was raised to that level from the start of the 2009/10 tax year.

For more on the IHT residence nil rate band read Martin Campbell’s article explaining how it works in practice.

The business tax related measures announced at the UK Budget included:

There was also a range of Capital Allowances measures announced to encourage capital investment by businesses including a temporary 130% super-deduction for investment in certain plant and machinery.

The temporary increase in the SDLT nil rate band for residential property in England and Northern Ireland to £500,000 as part of the UK Government’s Coronavirus support package will continue to 30 June 2021. From 1 July 2021 to 30 September 2021 the nil rate band will be reduced to £250,000. The nil rate band will return to its standard amount of £125,000 from 1 October 2021.

The previously announced SDLT 2% surcharge for non-UK residents on all residential rates of SDLT will come into effect from 1 April 2021 for residential property purchases in England and Northern Ireland.

There will be full relief from SDLT on the purchase of land or property within one of the designated Freeport tax sites in England, where it is purchased and used for a qualifying commercial purpose.

Our Private Client Services team offers a full portfolio of advisory services in tax planning, asset protection and family advice. It is a full-service solution that is always tailored to meet individual and family needs.

For further tax compliance or tax planning advice, please contact Martin Campbell, Director of Tax Services or Alison Pryde, Tax Director, in our tax department. We would strongly recommend that you seek specialist advice tailored to your own circumstances before taking any action.

For financial planning and investment advice, please contact James Glass or Neil Cameron at Anderson Strathern Asset Management Limited.

Anderson Strathern Asset Management Limited is authorised and regulated by the Financial Conduct Authority.